Banking technology – Financial and Banking Challenges | Parallels Insights

Who Is This Banking Technology Guide Intended For?

The banking technology guide is designed for IT managers that handle financial services IT solutions and other professionals who administer banking, financial services, or insurance IT infrastructure (BFSI). It will provide information to IT administrators who are looking for an application and desktop delivery solution that is cost-effective, reliable, and meets requirements set by government regulations and industry laws.

This solution allows the IT team to increase network security and take control of everything that is happening across the infrastructure and workforce. At the same time, an application and desktop delivery software provide employees with instant and easy access to the data they need to provide a first-class experience for customers.

Why Are BFSI Institutions Investing in Cloud Computing?

Parallels understand the challenges financial services organizations face. BFSI organizations are under immense pressure to respond to new compliance regulations and cybersecurity threats while implementing technologies that support the business. As mobile technology continues to transform the way customers interact with companies, innovation is crucial to attract and retain customers. Online banking, call-centers, and mobile apps are touchpoints customers expect; however, adapting current systems to be web- and mobile-ready is no easy task, especially for custom-made or legacy systems.

On the other hand, providing anytime access for customers to customer-facing resources and for employees to internal systems promotes flexibility. IT innovations in fields such as mobile, the cloud, the Internet, and security are supporting the way people work and how consumers interact with services at banks, stock brokerages, investment funds, insurance companies, consumer credit organizations, and other financial sector companies. The challenge is to make these innovations available without affecting the business or requiring significant investment on the part of the BFSI institution.

Therefore, BFSI institutions must invest in their IT infrastructure to remain competitive in the marketplace. Cloud computing allows these institutions to set up a secure network easily and centrally control all the branches’ activity. At the same time, a private cloud provides employees with the ability to access corporate data securely from anywhere, anytime. Application and desktop delivery is a technology that leverages the cloud so financial services organizations can achieve this high level of sophistication while reducing costs and delivering mobile availability.

To adapt to new customer and employee expectations, financial services organizations must feature an application and desktop delivery solution that:

- Protects business and customer data from breaches while reducing risk and guaranteeing compliance.

- It is easy to use and maintain, therefore allowing them to reduce the systems administration overheads and costs.

- Delivers business and legacy applications to major devices across all channels, including web, mobile, and desktop.

- Reduces IT infrastructural costs and complexity, both through a cost-effective license plan as well as through after-purchase value, by growing with the business efficiently.

- Ensures business continuity for both customers and employees, with no interruptions, crashes, or abrupt cessations of service.

Below are some of the benefits to any BFSI institution when IT departments invest in modern virtualization IT infrastructure:

Security and Centralization of Data

Security is the most significant concern for BFSI institutions. To address this concern, advanced IT solutions are built with security at the forefront. Further, today’s top-quality networks allow IT managers to set up a private, secure cloud where they can centralize and protect all of the organization’s sensitive data. Robust authentication mechanisms to control access also exist. Last but not least, a current IT solution encrypts all user connections, making sure that connections are not vulnerable to man-in-the-middle attacks. The current IT solution must be protected from within the local (LAN) and the Internet (WAN) networks.

Scalability and Control

Scalability is a mandatory requirement for BFSI institutions. The majority of banks and financial institutions have multiple branches across various states and also in foreign countries. Advancements in technology have resulted in software that can be easily scaled without breaking the budget. When investing in an IT solution, BFSI institutions must be able to scale the network with minimal effort to keep up with today’s changing business demands while retaining control of every asset along the way.

Reduce Overhead

BFSI institutions want a secure and scalable IT system, but they still need affordable and straightforward administration controls. Fortunately, there are many ways to achieve these requisites that don’t require setting up high-end servers or investing in massive on-site infrastructure.

Modern technology and virtualization allow efficient use of hardware. Institutions can set up a system that provides enterprise features, such as load balancing, without requiring significant physical hardware or maintenance. Furthermore, a virtualization IT solution allows administrators to connect remotely to users’ devices and walk them through any issues they encounter. As a result, IT staff do not need to physically interact with the individual devices to address network issues as they arise, which allows them to assist employees in less time.

Guarantee Business Continuity

BFSI customers want access to their accounts anytime, anywhere. Advanced IT infrastructure solutions have all the necessary features to build a high-availability software solution that ensures not only maximum uptime but also the available resources to enable users’ and customers’ broad access to data when connected to the system.

Out-of-the-box BYOD to Support Mobile Solutions

Many bank employees leave the office regularly to meet with prospects. These employees need access to their organization’s data while on their mobile devices to provide top-notch customer service. Traditional IT infrastructure solutions make this a difficult task, mainly due to hardware compatibility issues and the security of the connection. Moreover, customers expect mobile banking services, such as online banking, contact centers, and mobile applications. The financial institution’s IT infrastructure needs to support these services even for legacy line-of-business applications.

Many bank employees leave the office regularly to meet with prospects. These employees need access to their organization’s data while on their mobile devices to provide top-notch customer service. Traditional IT infrastructure solutions make this a difficult task, mainly due to hardware compatibility issues and the security of the connection. Moreover, customers expect mobile banking services, such as online banking, contact centers, and mobile applications. The financial institution’s IT infrastructure needs to support these services even for legacy line-of-business applications.

Scaling Up the System to Meet Demand

Large institutions need to be able to scale up their systems quickly and efficiently to continuously produce the demands of their customers. Yet, many of the legacy IT solutions were not designed to be scalable; financial firms often have to spend a fortune to build custom and complex workarounds to scale up their existing IT operations.

Avoid Expensive Hardware Bills

Large financial institutions have hundreds or thousands of employees. These institutions have to run the latest, most secure operating systems because of compliance and security concerns. Modern operating systems are resource-hungry, which means the hardware has to be replaced frequently at a high cost to the institution. Desktop VDI delivery can transform old machines into thin-client-like machines with modern operating systems and updated security features. This allows the IT department to continue running older machines for an extended time.

Take Advantage of Windows Server 2016 Updates

Microsoft® made a significant investment in Windows Server® 2019 to bring its infrastructure up to date in the modern era of cloud computing. In turn, this is pushing many IT administrators who rely on Windows® OS further down the path to investing in private cloud capability. Windows Server’s latest iteration includes support for containers and tighter integration with Microsoft’s Azure® cloud service. It also includes more security for Hyper-V® virtual machines and improvements to Remote Desktop Services, which is also now interoperable with Azure. Moreover, Windows Server 2019 adds layers of protection to guard against emerging cybersecurity threats. However, Microsoft’s Windows Server 2019 and RDS aren’t complete solutions on their own, and they still require third-party applications to simplify and improve performance.

Recommended Cloud Solution for Banking technology

Parallels Remote Application Server

Parallels® Remote Application Server (RAS) is an industry-leading solution for virtual application and desktop delivery. With its impressive, native-like mobile experience on iOS and Android™ devices, Parallels RAS is popular among financial institutions. Not only does it require minimal effort, but it is also easily scalable and works with Microsoft RDS and all major hypervisors. Parallels RAS makes financial and banking IT challenges easy to overcome by:

- Setting strict safeguards for corporate and customer data transfer to mitigate risk and adhere to government regulations.

- Delivering a brilliant, multiplatform-supported customer experience that meets and exceeds client expectations, no matter what device they’re on.

- Allowing employees and managers immediate mobile access to apps, desktops, and data—with a native-like experience even when they’re away from the office.

- Optimizing the IT department budget’s ROI through increased infrastructure efficiency and lower IT staff overhead, thanks to highly streamlined management and advanced control options.

- Boosting business responsiveness through a high availability network that includes effective, easy-to-configure load-balancing to ensure service is provided without interruption.

Parallels RAS provides reliable, easy-to-scale IT infrastructure that centralizes and protects sensitive data on a secure private cloud. With features such as multi-factor authentication support, connection encryption, remote Control of end-users’ sessions, and built-in load balancing, among several others. Parallels RAS is suitable for financial institutions that are looking to replace their legacy, high-maintenance IT system with an advanced, user-friendly, cloud-based IT solution.

Why Financial Institutions should adopt Parallels RAS as part of their banking technology

To Improve IT Infrastructure Security

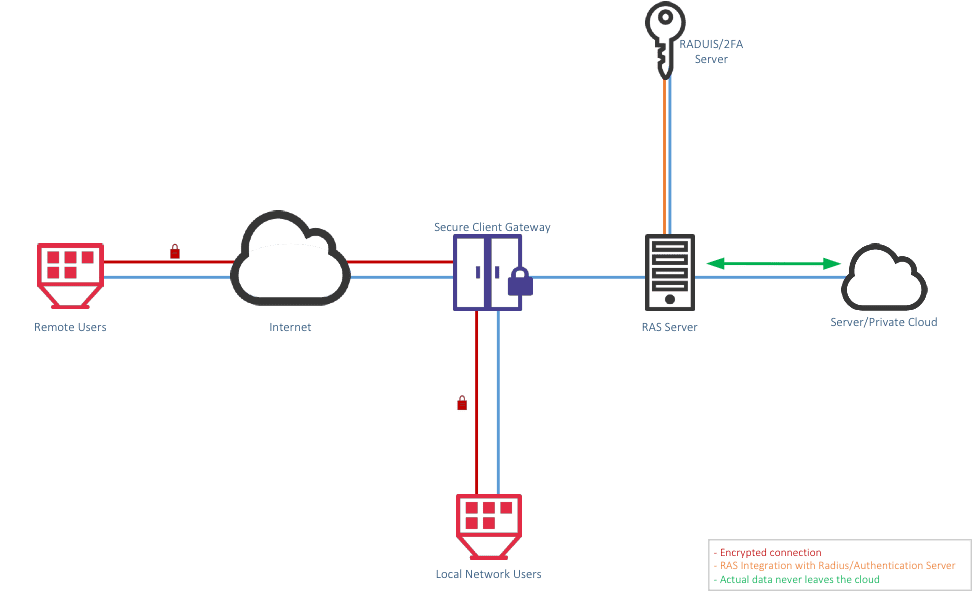

Security is a top concern for BFSIs. As a result, Parallels RAS includes strict security features and controls. When installing and configuring the setup, IT administrators create a private cloud where all of the business’ critical data is centrally stored and secured. Centralizing all of the data in a private cloud guarantees the data is protected and that no terminal contains any sensitive data. Further, the Parallels RAS advanced filtering features allow IT administrators to control who has access to specific data and when. On top of that, Parallels RAS features an end-to-end SSL and FIPS 140-2 encrypted connection and DMZ deployment options as a final security layer against malicious users on the web.

To Create More Robust Authentication

The Parallels RAS solution can also be integrated with third-party, multi-factor authentication servers such as Gemalto, DeepNet, RADIUS, or Google Authenticator, allowing implementation of more robust verification mechanisms. With multi-factor authentication, all employees log in by using one-time token generators to make sure there won’t be any intruders penetrating the system. As an example, multi-factor authentication keeps the network safe in the event an employee’s personal computer is stolen or compromised by a cyberattack.

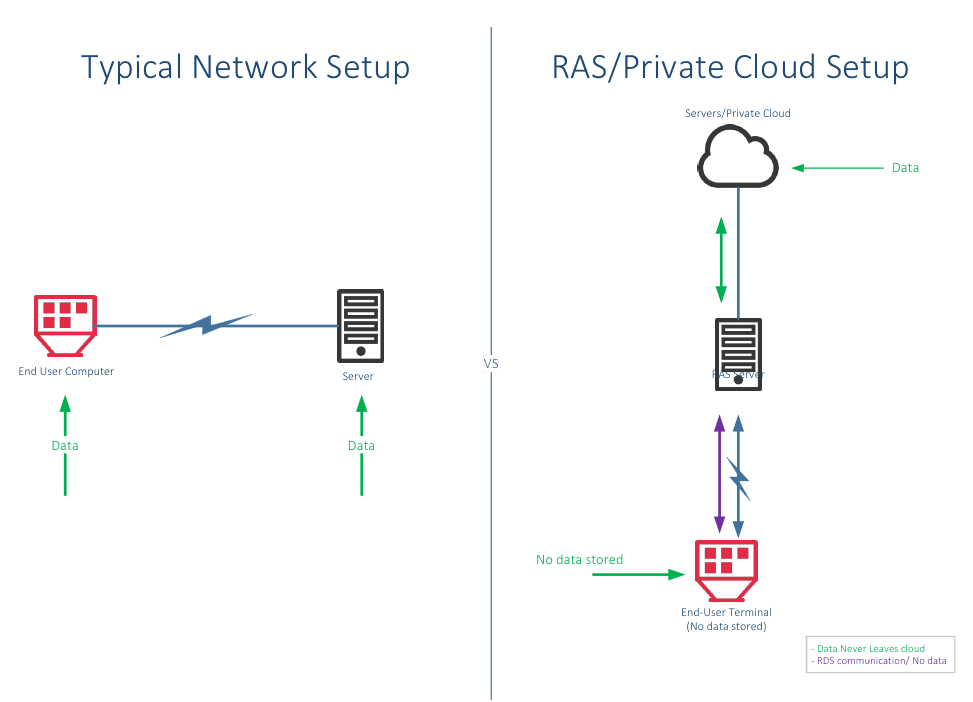

To Centralize Data for Reliable Backups and Management

By centralizing all the data in the private cloud, IT staff can ensure that no data is stored on end-users’ terminals. When backing up data with Parallels RAS, all data is stored in a central location. This differs from traditional networks, where most of the data cannot be backed up because the end-user terminal is unavailable or inaccessible. In addition, because the private cloud has a single point of entry (through the Parallels RAS infrastructure), IT staff can easily keep track of who accesses what resources through the managed connections.

To Reduce Hardware Costs

The benefits of implementing modern virtualization IT solution are multifold:

Use All the Resources Available

As opposed to having dedicated hardware for every server, where the hardware resources are never fully utilized, virtualization allows multiple servers to run on a single hardware unit. Therefore, virtualization requires less hardware by making more efficient use of the resources available.

Extend the Life of End User Terminals

By using the desktop replacement features in Parallels RAS, IT staff can change the typical desktop computer into a stripped-down, thin-client-like operating system. The desktop replacement features require fewer resources than a full-blown operating system and result in reduced costs by repurposing older computers on the network.

Lower IT Administration Overheads

Parallels RAS is straightforward to configure and launch. It’s not necessary to spend days planning the IT infrastructure and reading through a stack of documents to understand the product. For example, Parallels RAS wizards allow IT staff to set up a private cloud with an application and virtual desktop delivery capabilities within minutes. Most of the terminal server and VDI management tasks can easily be automated. Enterprise features, such as universal printing and load balancing, do not require additional configuration and are ready immediately following the initial installation.

Implement Unrestricted BYOD/CYOD and Device-Independent Policies

The Parallels RAS Client can run on iPhone®, Android, iPad®, Chromebook™, Mac®, Linux®, Windows, and thin-client devices. Thanks to its broad compatibility features, IT staff using Parallels RAS deliver a seamless user experience to anyone on the network. This makes a Bring-Your-Own-Device (BYOD) or Choose-Your-Own Device (CYOD) policy easy to implement, regardless of scale, employees, or customer device preferences. In addition, support for such a wide range of operating systems means the department isn’t restricted to buying specific, expensive hardware.

Allow Workers to Access Their Data Anywhere, Anytime

By supporting a wide range of operating systems, workers who are not in the office can access their data anytime, from anywhere. This means that BFSI remote workers can now provide a superior customer service experience because they have all the information they need at their fingertips.

Parallels RAS revolutionizes the use of mobile phones for the business. Any Windows application on iOS or Android devices will be fully functional and feel like a natively developed mobile app. Employees can use familiar touch gestures to select, copy, and paste text precisely, making pushing a small desktop button or dragging a picture effortlessly.

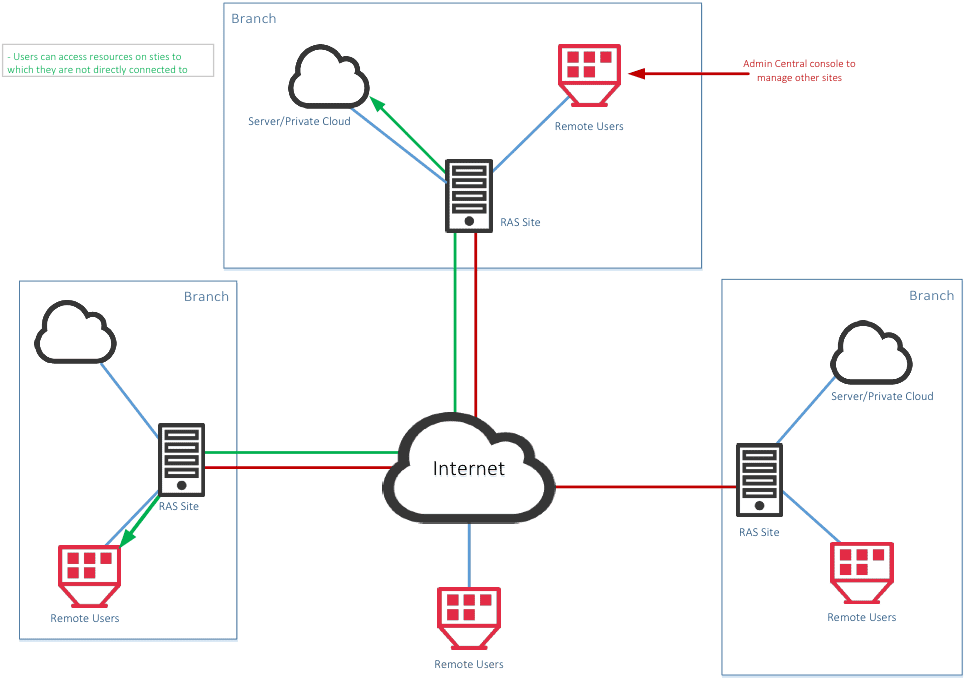

Provide Multi-site Support from a Central Console

Multi-site support allows IT network operators to connect with all the different Parallels RAS sites under one farm and manage them from a central console. It’s an ideal support feature for institutions that have multiple branches in various geographic locations. Administrators can also allow users to connect and access resources of sites to which they are not directly connected, creating an efficient system where resources are distributed with ease in a timely, balanced, and secure manner.

Implement Multi-administrator roles

To complement multi-site support, administrators can also implement multiple administrator roles and granular permissions that allow delegation of specific tasks. For example, one administrator can be responsible for all the operations, or just a section of the activities of a single site. This allows the CIO and higher-level IT managers to concentrate on the operation of the global IT infrastructure.

Improve Windows Server and Microsoft RDS

Parallels RAS enhances Windows Server and RDS infrastructure to provide the functionality and flexibility that businesses need. While it takes advantage of Microsoft’s improved cloud-based protocols, Parallels RAS is a cost-effective and time-saving alternative that is easy to manage and scale. Utilizing both its protocol and Microsoft RDS, Parallels RAS brokers the connection between RDSH applications and desktops to client devices. As a result, the graphics and performance improvements of OpenGL available in WS are automatically implemented. When using Parallels RAS, the complex Microsoft RDS framework is overhauled into a streamlined, comprehensive solution with an exceptional end-user experience and a straightforward, easy-to-use command console, among other improvements.

Parallels RAS Implementation Recommendations for Banks and Financial Institutions

Centrally Manage the IT Infrastructure of Geographically Dispersed Branches

After the IT department administrator sets up the infrastructure, the next step is to install a Parallels RAS site in each branch so that all of them can be centrally managed and their published resources shared. In this setup, the IT staff can be granted permission to access published resources on sites they are not directly connected to, allowing IT administrators to use their resources more efficiently.

Delegate the Management of the Sites

IT managers should also create multiple administrator accounts and configure granular permissions to delegate administrative and maintenance tasks to subordinates. This allows managers to continue focusing on the operations of the global IT infrastructure.

Improve Infrastructure Security

Security is a top priority at any BFSI institution, so it’s crucial to enable end-user connection encryption.

Ideally, to implement stronger verification mechanisms, IT managers should also integrate Parallels RAS with multi-factor authentication such as Safenet, Deepnet, or any other type of Radius authentication server. Parallels RAS supports smart card authentication for both Windows and Linux, which can be used to bolster the entire IT system security protocol.

Desktop Replacement Improves Data Management & Extends Hardware Life

IT managers can use the Desktop Replacement feature in Parallels RAS to extend the life of department hardware and lower IT costs. By converting the end-users’ machines into thin-client-like devices, the IT staff ensures that data is not being stored on the device but rather on the central private cloud. This will protect the network if an end-user terminal is lost, stolen, or hacked, and will also extend the lifespan of the older computers on the network.

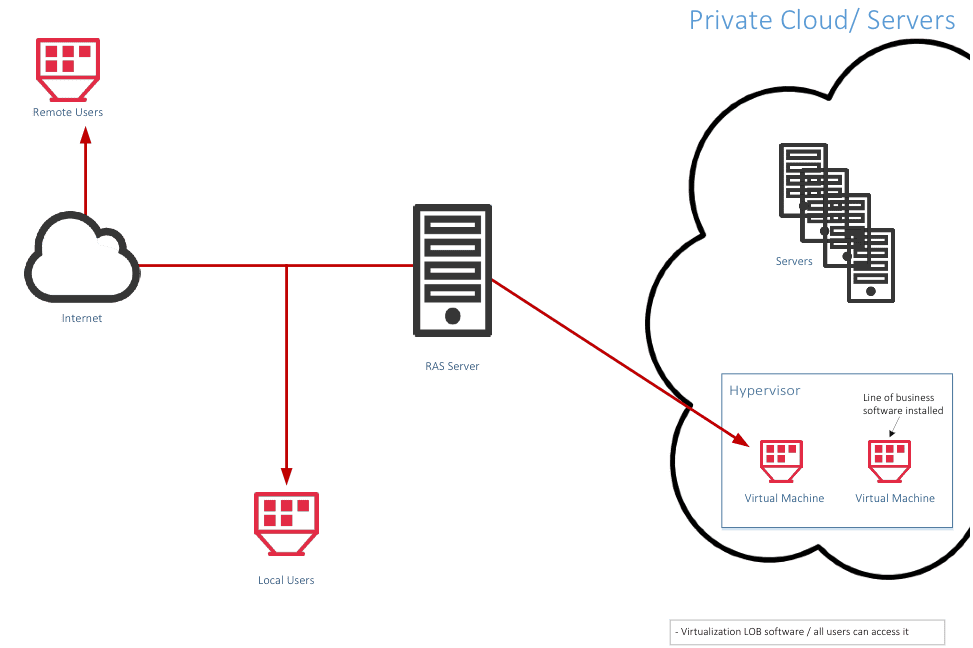

Deliver and Centrally Manage Line-of-Business Applications

Custom-made line-of-business (LOB) software applications often have high overhead and many shortcomings, such as limited mobile support or security flaws. Use Parallels RAS to install LOB applications on a virtual desktop instance uploaded to the private cloud. By doing so, IT managers can centrally manage the applications, making sure they’re backed up, and allow the staff to access them from their mobile devices rather than only from their office computer.

By centralizing these types of applications, IT managers also reduce maintenance requirements. For example, during upgrades, the IT Admin only has to perform a single central installation instead of manually upgrading every instance of the application.

Download your free trial of Parallels RAS today.

References

www.bankingtech.com | http://www.bankingtech.com/

www.computerworlduk.com | http://www.computerworlduk.com/it-business/how-technology-will-transform-banking-in-2016-blockchain-digital-banks-iot-3631853/

www.capgemini.com | https://www.capgemini.com/resource-file-access/resource/pdf/banking_top_10_trends_2016.pdf

www.edgeverve.com | https://www.edgeverve.com/finacle/resources/finacleconnect/truly-digital-banking/Pages/feature.aspx

deloitte.com | https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html